How Non-Recourse Factoring Can Support Cash Flow for Growing Businesses

Introduction to Non-Recourse Factoring

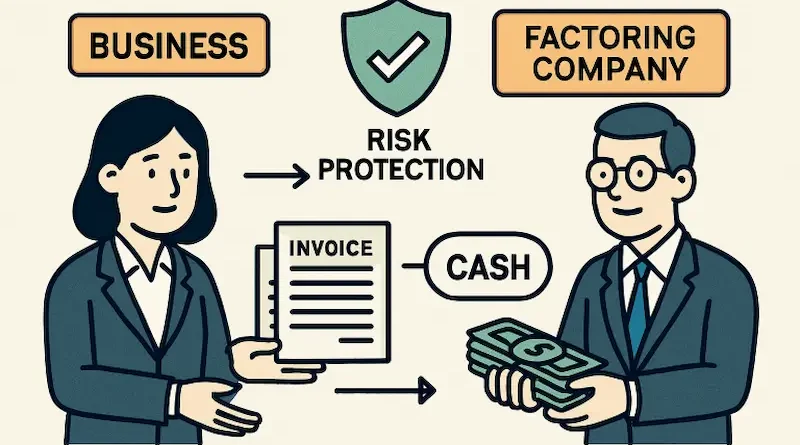

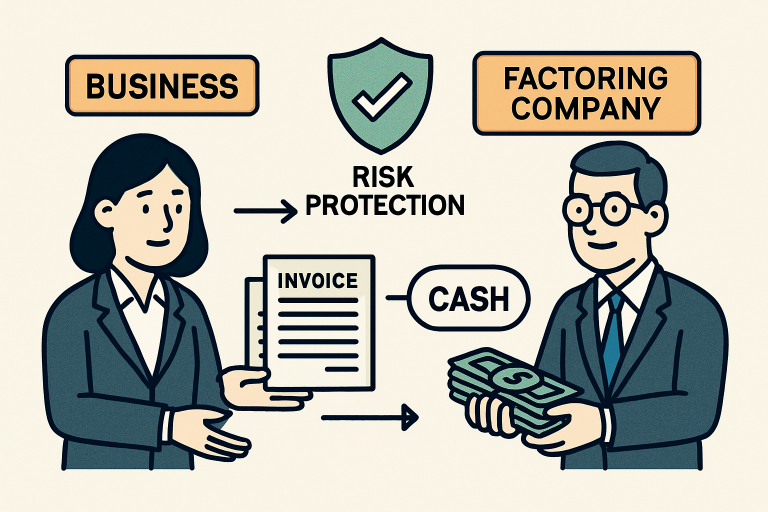

Growing businesses frequently encounter challenges related to cash flow, which can stunt growth and limit their ability to seize new opportunities. Traditional bank loans and credit lines may not be feasible for all companies, especially those operating in dynamic or volatile industries. This is where non-recourse factoring for small businesses becomes a practical financial solution. Through this approach, businesses sell their accounts receivable to a factoring company and benefit from immediate liquidity without assuming the risk of customer non-payment.

For companies targeting rapid expansion, managing receivables efficiently is essential to keep the pipeline moving. Non-recourse factoring not only provides much-needed cash flow but also shifts the potential financial burden of unpaid invoices to the factoring company. This allows business owners to focus their energy on building their operations instead of worrying about delinquent accounts.

Unlike recourse factoring, where the business must repay the advance if a customer defaults, non-recourse agreements are designed to insulate companies from the sting of bad debts. This distinction is especially crucial in sectors where customer solvency can often be unpredictable.

As businesses weigh the best way to meet payroll, add inventory, or fund growth initiatives, factoring may offer a more flexible and accessible alternative to traditional lending—a critical consideration for those without significant assets or established credit histories.

Understanding how these financing options work and their potential impact is important for business owners looking to maintain a competitive edge. According to the NerdWallet article on recourse vs. non-recourse factoring, this type of financing has been a lifeline for companies needing immediate cash while protecting against risky accounts receivable.

Benefits of Non-Recourse Factoring

Non-recourse factoring provides a number of meaningful advantages for growing businesses:

- Immediate Cash Flow: Quick access to working capital is critical for daily operations. Factoring allows businesses to tap into the value of their receivables, often within 24 hours, helping to fund payroll, pay suppliers, and cover other operational costs.

- Risk Mitigation: By transferring the risk of customer insolvency to the factor, companies greatly minimize their exposure to bad debts and the negative impact that lost revenue can have on their balance sheets.

- Administrative Relief: Factoring companies provide professional collection services, conducting credit checks and overseeing accounts. This frees up internal resources, allowing businesses to streamline their operations and focus on their core competencies.

- Credit Building: As businesses consistently receive advances and remit payments on time, they can build a stronger credit profile, which may make it easier to qualify for other types of financing in the future.

- No Collateral Requirements: Unlike most traditional financing options, non-recourse factoring does not require collateral such as equipment or property, making it especially attractive to entrepreneurs and newer businesses.

How Non-Recourse Factoring Works

- Invoice Submission: The business provides the factoring company with a list of accounts receivable it wishes to sell.

- Advance Payment: The factoring company advances a significant portion—typically 70-90%—of the invoice value to the business, providing rapid liquidity.

- Collection: Upon customer payment, the factoring company collects the full invoice amount directly from the customer.

- Final Payment: The remaining balance, minus the agreed-upon factoring fee, is remitted to the business once the customer pays in full. If the customer defaults due to insolvency, the business is shielded from liability under the non-recourse agreement.

This simple, reliable approach helps stabilize cash flow, regardless of customer payment cycles.

Industries That Benefit from Non-Recourse Factoring

Several industries stand to gain significant support from factoring, particularly those where payment timelines are extended or customers’ creditworthiness is unpredictable:

- Manufacturing: To finance production expenses and ensure steady operations despite extended payment terms from buyers.

- Trucking and Logistics: To cover recurring costs like fuel, maintenance, and payroll, often before customers release payments.

- Staffing Agencies: To maintain timely payroll for employees while awaiting payment from client companies.

- Apparel and Textile: To fund new inventory and manage seasonal demand, bridging the gap between order fulfillment and customer payments.

According to insights from NerdWallet on recourse vs. non-recourse factoring, the versatility of factoring makes it particularly useful to fast-growth sectors and businesses with capital-intensive operations.

Choosing the Right Factoring Company

Not all factoring companies are created equal. To secure a favorable partnership, businesses should evaluate several key factors:

- Reputation: Assess the background, reliability, and client reviews of potential partners to gauge satisfaction and trustworthiness.

- Terms and Fees: Understand the structure of advance rates, factoring fees, and contract flexibility to avoid hidden costs and long-term commitments that may not serve your interests.

- Industry Experience: Select companies familiar with your specific sector, as this ensures familiarity with industry norms and customer payment cycles.

- Customer Service: Clear communication, access to dedicated representatives, and transparency in operations can significantly improve your experience with the factor.

Common Misconceptions About Non-Recourse Factoring

- Cost Concerns: Some business owners assume factoring is too expensive due to associated fees. While fees exist, the risk protection and administrative support often justify the expense, especially compared to potential losses from unpaid receivables.

- Loss of Control: It’s a common fear that using a factoring company means losing customers or sacrificing client relationships. In reality, reputable factoring companies prioritize professional collections and maintain positive business interactions.

Factoring remains misunderstood by some, but when leveraged wisely, it offers a strategic advantage in managing business growth and protecting against financial volatility.

Conclusion

Non-recourse factoring represents a valuable resource for businesses seeking to stabilize cash flow, mitigate risk, and accelerate growth. With no need for collateral and minimal risk of bad debt, companies gain the freedom to reinvest, expand, and focus on long-term objectives. By understanding the process and selecting a reputable factoring partner, businesses of all sizes can turn outstanding invoices into strategic opportunities for success.