5 reasons why UPI payment gateways are ideal for small businesses in India

India’s small business economy is undergoing a digital revolution. According to Press Information Bureau (PIB), the Digital Payments Index reached 465.33 in September 2024, up from a base of 100 in 2018.

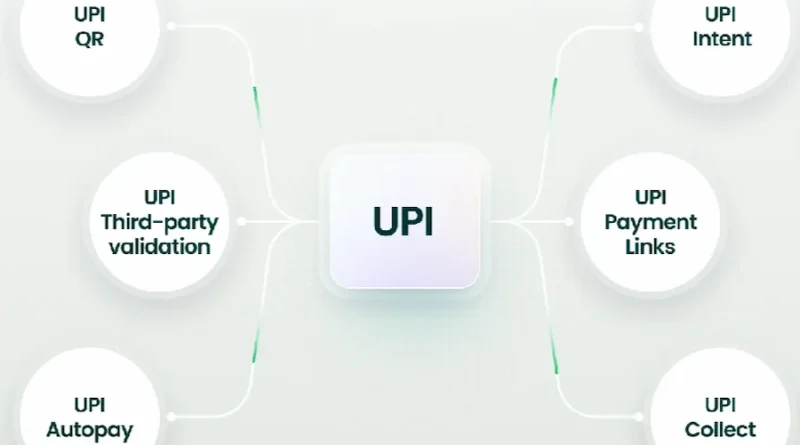

For small retailers, entrepreneurs and service providers, this transformation has unlocked access to fast, secure and affordable financial tools. The UPI payment gateway has become a key enabler, allowing even the smallest enterprises to accept digital payments instantly without expensive infrastructure.

From local grocers to boutique owners, small businesses now have the same digital capabilities once reserved for larger enterprises, narrowing the gap and enabling fair competition in a connected marketplace.

Five ways UPI payment gateways accelerate growth for small businesses

The rise of small businesses across India reflects resilience, ambition and adaptability. The UPI payment gateway supports these traits through practical benefits that translate directly into growth.

1. Cost-efficient setup

UPI gateways work through simple QR codes or app-based solutions. Merchants can begin accepting payments quickly, with minimal setup and no recurring maintenance costs, making it ideal for small businesses managing tight budgets.

2. Real-time settlements

Small business success relies on liquidity. UPI allows instant transfers directly to the business account, improving cash flow management. Immediate settlements help owners reinvest in inventory, manage expenses and maintain operational continuity without waiting for lengthy reconciliation periods.

3. Broader customer reach

With over 350 million active users across UPI-enabled apps, small businesses can cater to a nationwide audience. A UPI payment gateway lets customers pay through their preferred platforms, ensuring convenience and expanding reach beyond physical geography.

4. Simpler reconciliation and reporting

UPI gateways come with automated dashboards that provide real-time transaction visibility. Owners can download reports, verify payments and manage accounting without manual entry. The simplicity saves time and reduces the scope for errors that often occur in cash-based or manual systems.

5. Enhanced trust and security

Every transaction is protected through encryption and two-factor authentication, making UPI one of the safest payment systems available. Customers trust its reliability, and that trust extends to businesses that use it.

Together, these advantages make UPI payment gateways more than a convenience tool; they are an operational engine that supports sustainable small business growth.

What should small businesses look for in a UPI payment gateway?

Small businesses do not just need digital payments; they need payment systems that quietly support daily operations. These factors help you choose wisely:

1. Compatibility with existing tools and workflows

Before choosing a gateway, small businesses should check how well it fits into their current tools and daily routines. See if it connects smoothly with billing software, online stores, accounting tools and Point-of-Sale systems you already use.

A UPI gateway that fits existing workflows reduces manual work and avoids confusion for teams handling payments every day.

2. Ease of onboarding and clarity of KYC requirements

Onboarding should feel simple, not overwhelming. Look for clear, stepwise guidance instead of scattered documents and confusing forms. Check how the provider handles Know Your Customer (KYC) verification and what documents are required for proprietors, partnerships or companies.

Transparent timelines and regular updates during onboarding help owners plan better and avoid disruptions to ongoing business activities.

3. Transparency of pricing, charges and hidden fees

Small businesses run on tight margins, so pricing clarity is essential. Ask for a simple breakup of all possible charges. Understand per-transaction fees, settlement charges, dispute costs and any additional monthly platform fees in advance.

A good UPI payment gateway will explain pricing without jargon, helping you predict costs and avoid unpleasant billing surprises later.

4. Quality of customer support and issue resolution

When payments fail, you need quick answers, not ticket numbers that go nowhere. Check support quality carefully.

Find out if you get phone, chat or email support and what the typical response time is for critical issues.

Ask how disputes with banks or networks are handled and who takes responsibility for fixing problems that affect your customers.

5. Flexibility to customise payment journeys for your use case

Different businesses need different journeys, even on the same payment rail. Flexibility matters. Look for options to adjust messaging, branding, payment options and confirmation screens to match your customers’ expectations.

A flexible UPI gateway lets you refine flows over time, improving completion rates without rebuilding the entire checkout experience.

6. Depth of analytics, alerts and business insights

Good analytics turn payment data into practical decisions. Check what reports and dashboards are available by default. Look for trends by time, location, ticket size and payment method to understand customer behaviour better.

Alerts for unusual failures, drops in success rates or delayed settlements help owners act early and protect revenue.

Strengthening India’s entrepreneurial growth story

Small businesses are the heartbeat of India’s economy, and the UPI payment gateway has given them a reliable way to thrive in the digital age. From instant settlements and reduced costs to broader customer access and enhanced security, it represents an essential evolution in how entrepreneurs operate and scale.

Through trusted partners like Pine Labs Online, businesses can offer secure, high-performing and consistent UPI payment experiences that subtly inspire confidence.

The platform’s seamless integrations, wide payment options including PaybyPoints and dependable performance ensure that each successful transaction reinforces trust and nurtures long-term customer relationships.

Visit the rest of the site for more interesting and useful articles.