How to Use a Line of Credit to Manage Seasonal Business Cash Flow

Understanding Seasonal Cash Flow Challenges

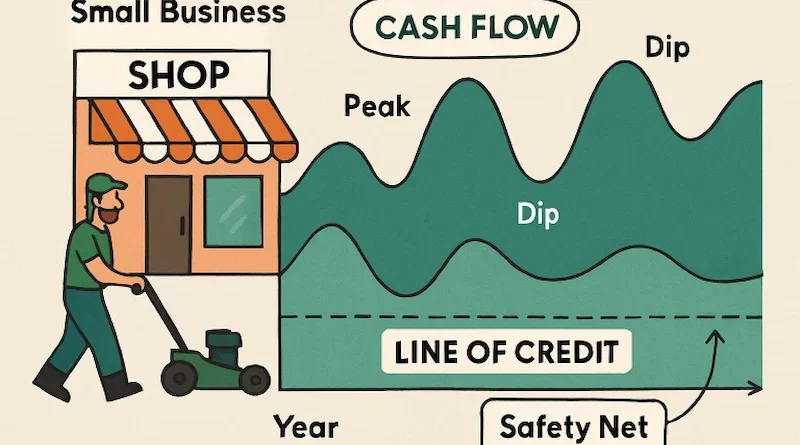

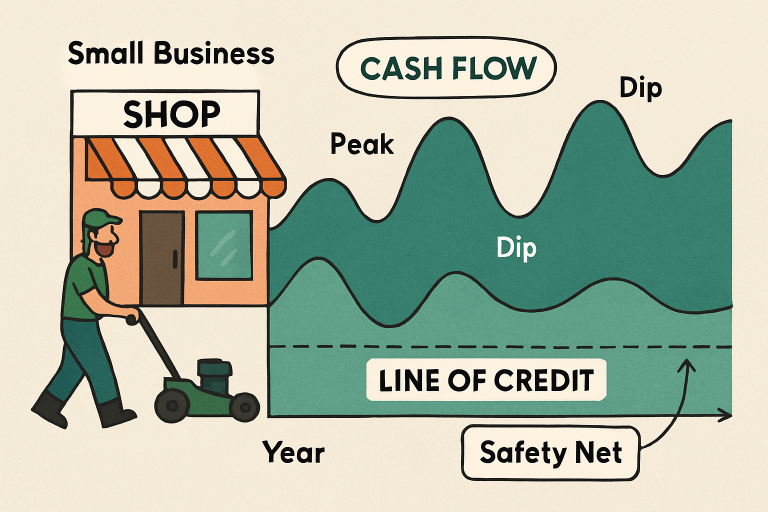

Seasonal businesses regularly encounter highs and lows in revenue, making cash flow management a top priority. In leaner months, covering operational expenses, maintaining inventory, and retaining staff become more challenging. If left unmanaged, these cyclical dips can threaten long-term stability or growth, which is where flexible funding becomes invaluable.

One effective strategy is to tap into invoice finance solutions or establish a revolving business line of credit to address cash flow gaps. These options let business owners access working capital on demand, smoothing out fluctuations between high and low seasons so they can confidently navigate off-peak periods.

When considering funding options, business owners should assess their cash flow needs’ timing, amount, and duration. Preparing a robust cash flow forecast can help visualize likely shortfalls and inform a sensible borrowing strategy. This proactive approach ensures that your business is not caught off guard when revenues dip.

The Role of a Business Line of Credit

A business line of credit functions similarly to a credit card but with higher credit limits and more business-friendly features. It allows you to withdraw funds whenever necessary, up to a specified limit, and repay them flexibly as your cash situation improves. This revolving access to funds gives seasonal business owners far greater flexibility than traditional loans, which disburse a lump sum upfront and require fixed repayments.

Unlike a term loan, interest on a line of credit is only charged on the amount drawn—not the full credit limit. This makes it an efficient and cost-effective solution for variable cash flow needs. During peak seasons, excess income can be used to pay down the borrowed amount, reestablishing the available limit for quieter months ahead.

Benefits of Using a Line of Credit for Seasonal Businesses

- Inventory Management: Draw funds to purchase inventory before peak periods, ensuring shelves are stocked to meet increased demand and seize sales opportunities.

- Payroll Support: Maintain consistent payroll during off-months, helping retain key staff and avoiding rehiring or training costs when business picks up again.

- Operational Expenses: Cover rent, insurance, utilities, and supplier payments even when cash flow is slow, preventing disruptions to core business activities.

These benefits reduce operational risk and support business growth by ensuring readiness and reliability throughout seasonal cycles. A flexible credit line creates peace of mind and frees management’s time to focus on long-term strategy rather than short-term financial challenges.

Strategic Use of a Line of Credit

To truly maximize the value of a business line of credit, it helps to approach funding with discipline and forward planning:

- Plan Ahead: Use detailed cash flow projections and sales forecasts to identify when you’ll need extra funds, how much to draw, and when to repay. Many seasonal businesses prepare cash flow statements for every quarter, not just annually.

- Use Funds Wisely: Allocate your funds to initiatives with the highest return—such as targeted marketing campaigns ahead of busy periods or securing bulk discounts on inventory.

- Monitor Repayments: Make timely repayments whenever cash flow strengthens. Maintaining good credit habits ensures that your business remains eligible for favorable terms on future borrowing and avoids excess interest costs.

It’s advisable to set reminders for repayment dates and track your drawdowns through online banking tools. This will ensure you never miss a payment and keep interest charges in check.

Alternative Financing Options

While a business line of credit is among the most flexible financing tools available, there are other options worth considering, especially for businesses seeking to diversify their funding sources:

- Invoice Financing: Convert unpaid invoices into working capital by selling them to a lender at a discount. This method can be particularly effective for B2B businesses with long client payment terms.

- Merchant Cash Advances: Receive a lump sum now in exchange for a future share of sales, usually repaid through card transaction receipts. This option provides quick access to capital but often carries higher costs than standard loans or credit lines.

Final Thoughts

Effectively handling seasonal cash flow is essential for businesses’ long-term health and stability with fluctuating income. A business line of credit is a versatile lifeline, empowering owners to bridge gaps and address challenges as they arise. By pairing smart borrowing strategies with careful financial management, seasonal businesses can lay the foundation for sustainable profitability—no matter how unpredictable the calendar year may be.

Visit the rest of the site for more interesting and useful articles.